(!)Due to Microsoft's end of support for Internet Explorer 11 on 15/06/2022, this site does not support the recommended environment.

Mon. - Fri. 8 a.m. - 6 p.m.

All Categories

-

Automation Components

Automation Components

Show all categories of Automation Components-

Linear Motion

-

Rotary Motion

-

Connecting Parts

-

Rotary Power Transmission

-

Motors

-

Conveyors & Material Handling

-

Locating, Positioning, Jigs & Fixtures

-

Inspection

-

Sensors, Switches

-

Pneumatics, Hydraulics

-

Vacuum Components

-

Hydraulic Equipment

-

Spray Equipment And Accessories

-

Pipe, Tubes, Hoses & Fittings

-

Modules, Units

-

Heaters, Temperature Control

-

Aluminum Extrusions, Framing, Support & Posts

-

Casters, Leveling Mounts, Posts

-

Doors, Cabinet Hardware

-

Springs, Shock Absorbers

-

Adjustment/Fastening Components, Pins, Magnets

-

Antivibration, Soundproofing Materials, Safety Products

-

- Fasteners

- Materials

-

Wiring Components

Wiring Components

Show all categories of Wiring Components-

LAN Cables / Industrial Network Cables

-

Equipment Specific Cables

-

Cordsets

-

Computer & AV Cables

-

Wire/Cable

-

Connector (General Purpose)

-

Crimp Terminal Components

-

Cable Organization

-

Cable Gland Components

-

Cable Bushing/Clip/Sticker

-

Screw/Spacer

-

Cable accessories

-

Tube

-

Electrical Conduits

-

Duct/Wiring

-

Electrical Wiring Tools

-

Dedicated tools

-

Soldering supplies

-

- Electrical & Controls

-

Cutting Tools

Cutting Tools

Show all categories of Cutting Tools-

Carbide End Mill

-

HSS End Mill

-

Concrete Drill Bits

-

Milling Cutter Insert / Holder

-

Core Drill Bits

-

Customized Straight Blade End Mill

-

Dedicated Cutter

-

Crinkey Cutters

-

Turning Tool

-

Drill

-

Cutting Tool Accessories

-

Screw Hole Related Tools

-

Reamer

-

Electric Drill Bits

-

Chamfering, Centering Tool

-

Hole Saws

-

Magnetic Drill Press Cutters

-

Step Drills

-

Wood Drills & Cutters

-

-

Processing Tools

-

Packing & Logistics Storage Supplies

- Safety Products

-

Research and Development & Cleanroom Supplies

Research and Development & Cleanroom Supplies

Show all categories of Research and Development & Cleanroom Supplies - Press Die Components

-

Plastic Mold Components

Plastic Mold Components

Show all categories of Plastic Mold Components-

Ejector Pins

-

Sleeves, Center Pins

-

Core Pins

-

Sprue bushings, Gates, and other components

-

Date Mark Inserts, Recycle Mark Inserts, Pins with Gas Vent

-

Undercut, Plates

-

Leader Components, Components for Ejector Space

-

Mold Opening Controllers

-

Cooling or Heating Components

-

Accessories, Others

-

Components of Large Mold, Die Casting

-

-

Injection Molding Components

Injection Molding Components

Show all categories of Injection Molding Components-

Purging Agent

-

Injection Molding Machine Products

-

Accessories of Equipment

-

Auxiliary Equipment

-

Air Nippers

-

Air Cylinders

-

Air Chuck for Runner

-

Chuck Board Components

-

Frames

-

Suction Components

-

Parallel Air Chuck

-

Special Air Chuck

-

Mold Maintenance

-

Heating Items

-

Heat Insulation Sheets

-

Couplers, Plugs, One-touch Joints

-

Tubes, Hoses, Peripheral Components

-

- Webcode Seach | Series

-

#CODE

- Discontinued Products

Loading...

- HOME

- > News

News

Invoices in CFDI 4.0

MISUMI Website Information

September 1, 2022

Invoices CFDI 4.0

Due to the 2022 Tax Reform by the Federal Government, version 4 of the CFDI electronic invoice was created, at MISUMI we are working to implement this tax obligation starting on October 1, 2022.

Despite having an extension by the government for its forced implementation to January 1, 2023, we will implement it sooner. This in order to ensure its operation and avoid problems that could affect the delivery of your products and invoices.

Official Communication of the SAT

Actions by our customers

As part of this process we are asking our clients to send us their "Constancia de Situación Fiscal" to the email credito-ar@misumimex.com this document has all the necessary information for the issuance of CFDI 4.0 as requested by the SAT. We are building our database in order to speed up the billing process and avoid rework or rebilling.

If you do not wish to send your Constancia, you can send us the necessary information consisting of:

- Federal Taxpayer Registry (RFC).

- Name or company name.

- Zip code of the fiscal domicile.

- Tax regime.

- Use of the CFDI.

(i)Attention

This information must completely coincide with the SAT records, there cannot be a single change, space, hyphen, accent or symbol different from the one registered with the SAT, if it does not coincide, your invoices cannot be issued.

Due to the need for absolute coincidence, we recommend sending your Constancia de Situación Fiscal

The document must be sent in the original format downloaded from the SAT (PDF), not scanned or modified in any way

How to obtain the Constancia de Situación Fiscal?

To obtain your Certificate of Fiscal Situation you can do it in the following ways:

SAT Web Portal

- Go to sat.gob.mx in the Other procedures and services section, click on Generate your Certificate of Tax Situation.

- Only the RFC and Password or valid electronic signature (e.signature) are needed.

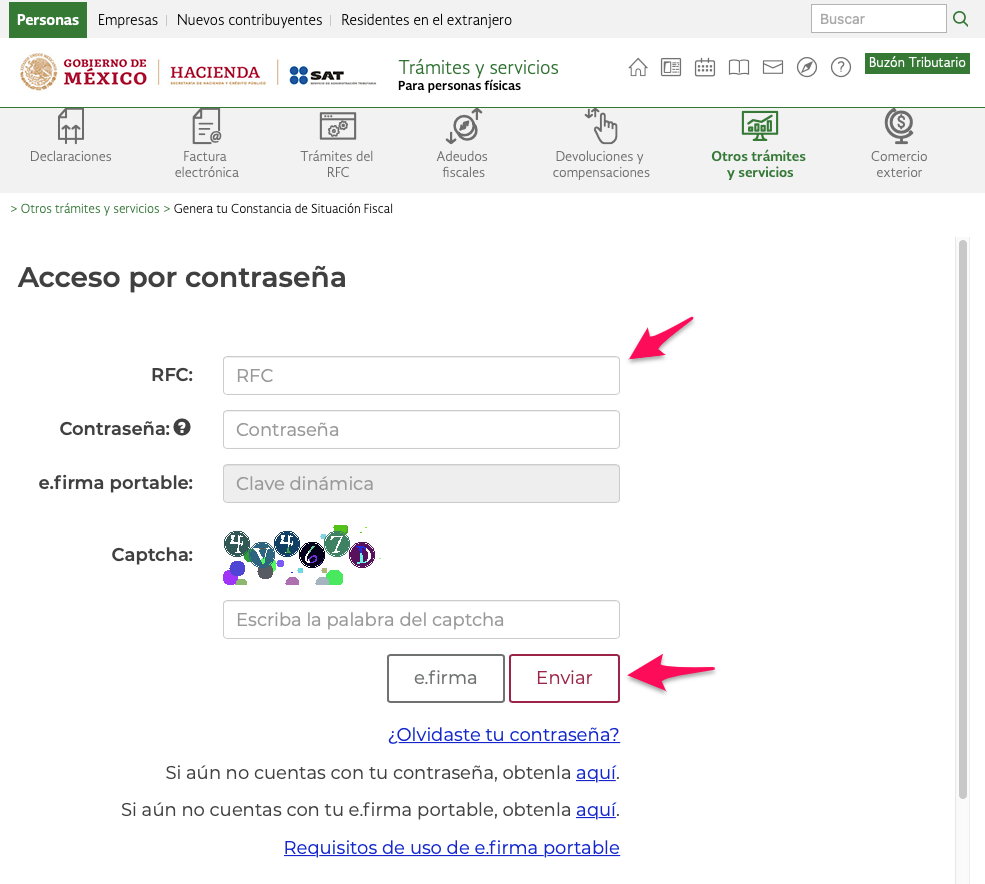

Step 1: Enter the SAT portal and click on "Other Procedures and Services"

Step 2: Enter your RFC and Password, you do not need the e.signature

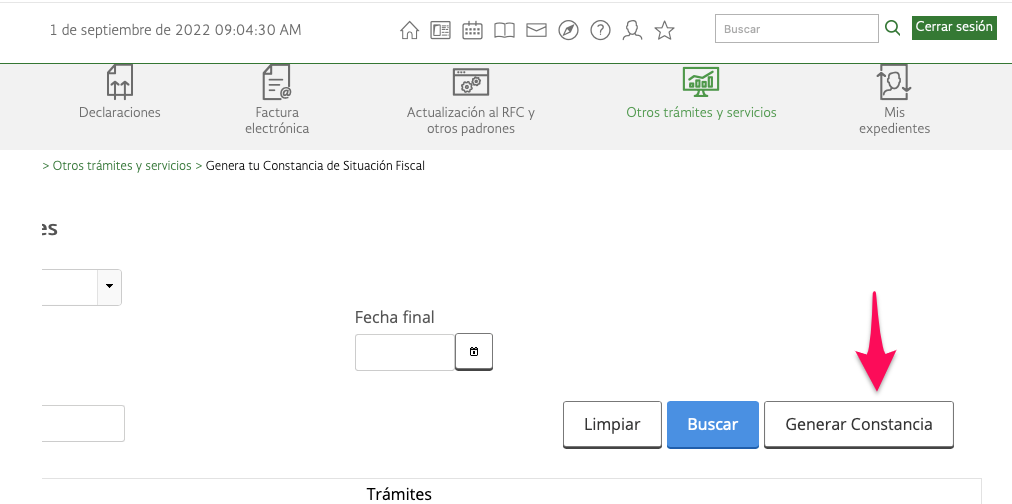

Step 3: Click on the "Generate Certificate" button located in the lower right corner, sometimes it is necessary to move the window to see the button.

SAT Mobile App

- Download the SAT Mobile application from any cell phone or tablet with an internet connection. App for iPhone and iPad , App for Android

- Only the RFC and Password are needed.

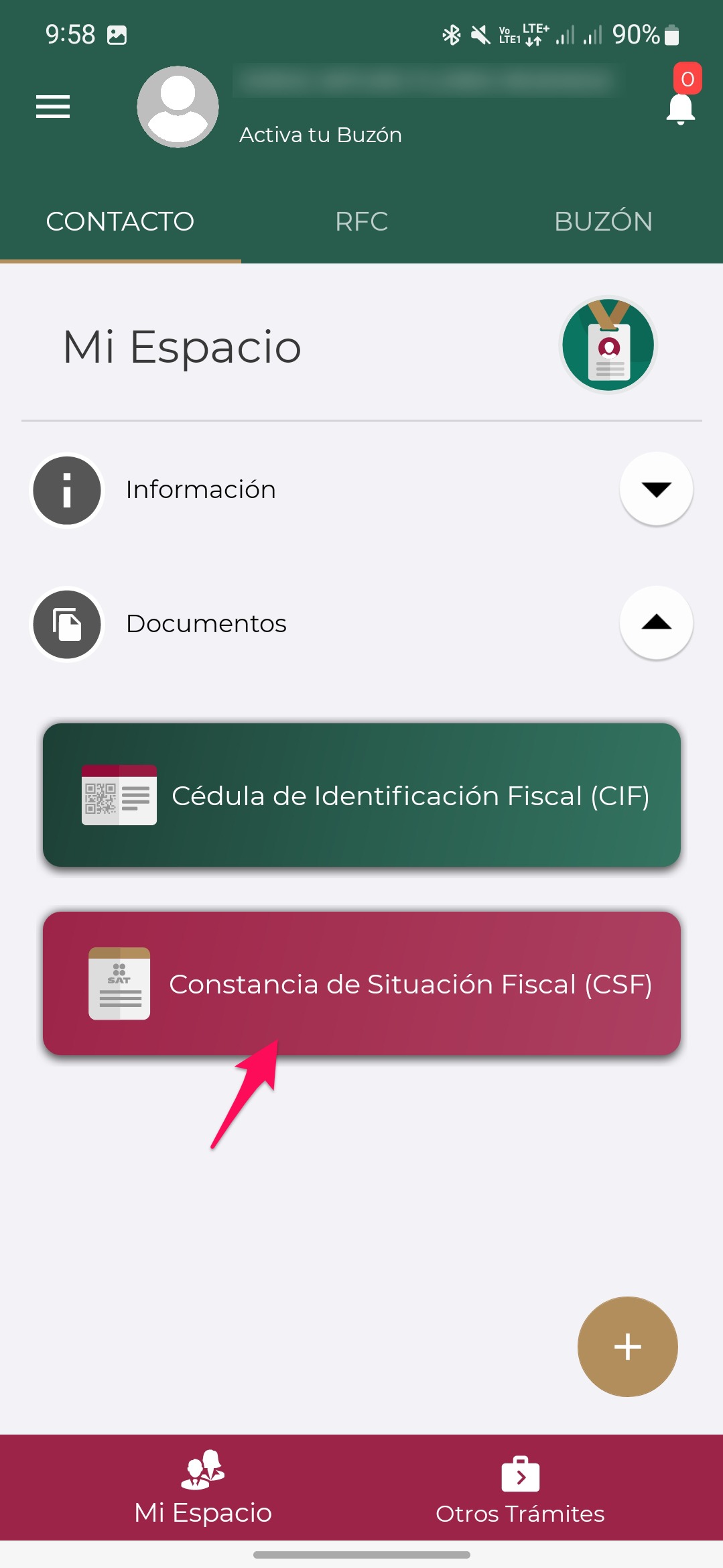

Step 1: Open the app and enter your RFC and password, you do not need the e.signature

Step 2: Click on the "Documents" button and then on "Constancia de Situación Fiscal"

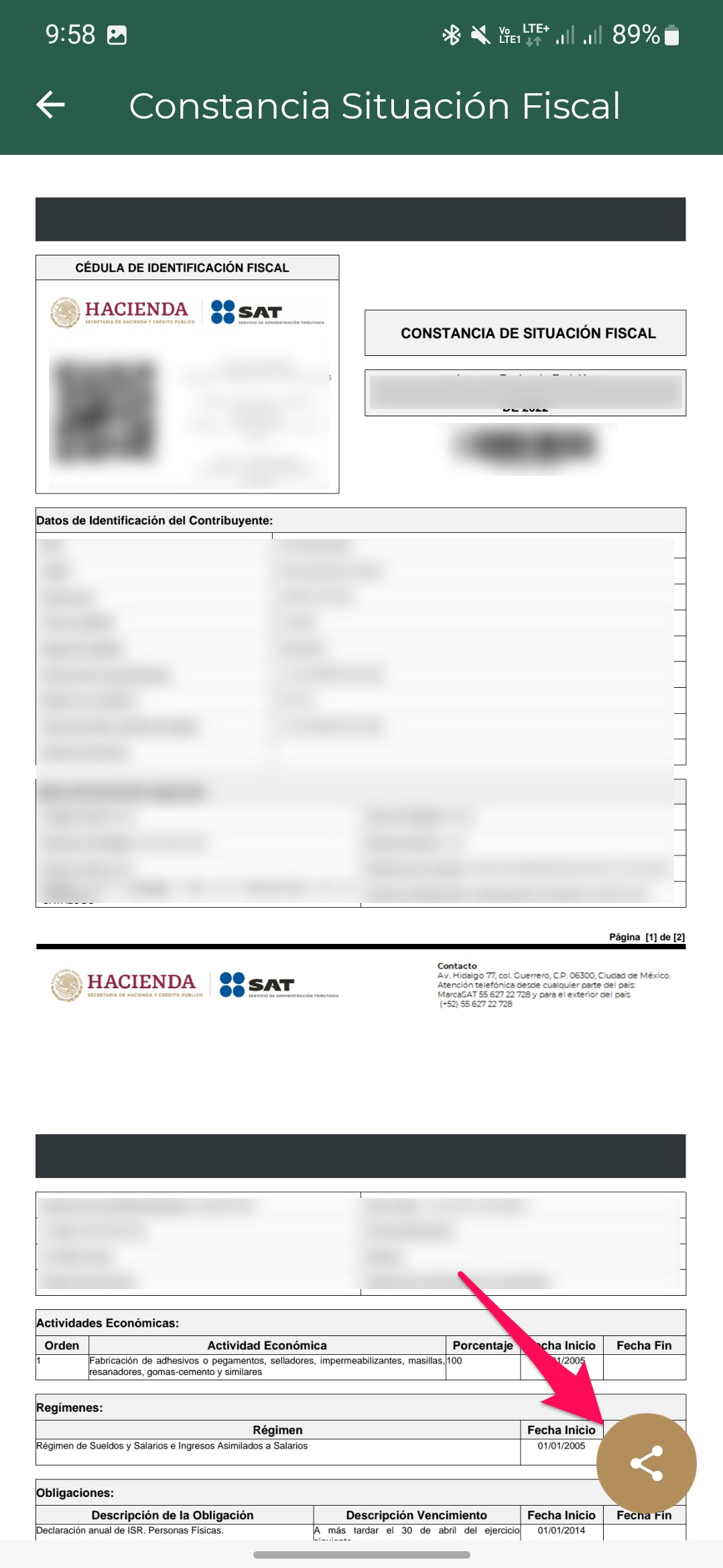

Step 3: Click on the share button to send your document by email

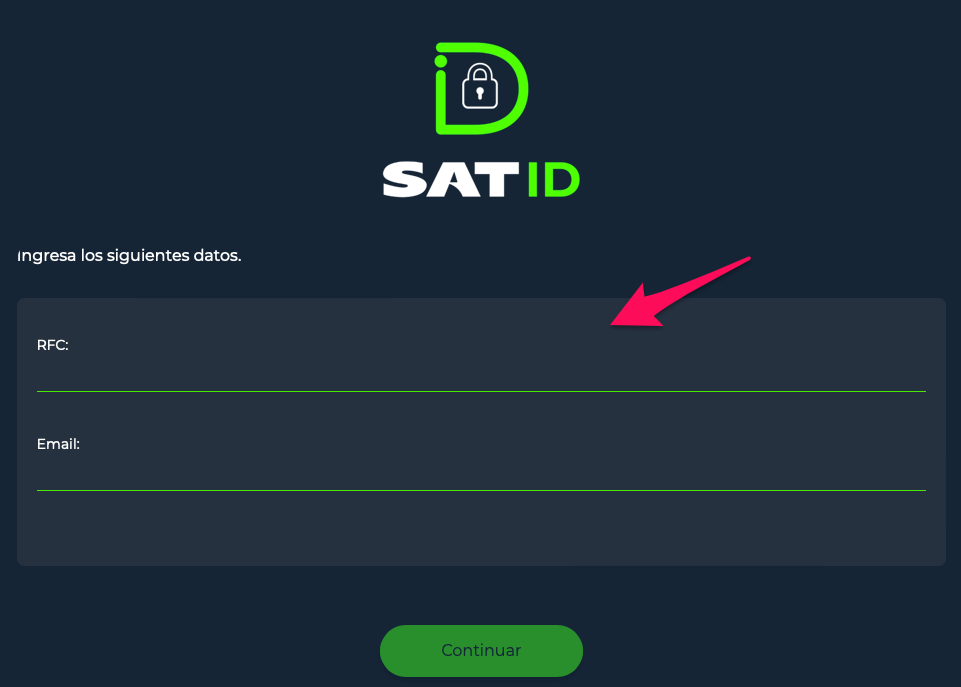

SAT ID

Go to SAT ID from any cell phone or tablet with an internet connection. Only need:

- Current official identification digitized or scanned.

- RFC to 13 positions.

- Personal email.

- Cell phone number to 10 positions.

Step 1: Enter SAT ID and click on "Constancia de Situación Fiscal con CIF"

Step 2: Enter your RFC and an email, you will receive a "Token" or password for one use

Step 3: Enter the Token that came to your email after step 2

Step 4: Attach your identification (INE or Passport), then it will ask for your phone number and then the Certificate will be sent to your email, this process can take days.

SAT Regional Offices

- You can attend any of the SAT offices without an appointment, you just need to bring an official identification and your RFC.

- Don't forget to bring a USB stick to save the PDF file

Send my Constancia

If you already have your Constancia, you can send it to our billing department by email credito-ar@misumimex.com or by clicking on the following button.